32+ how to deduct mortgage interest

AutoModerator 5 min. Web The home with the secured loan must have sleeping cooking and toilet facilities.

Mortgage Interest Deduction Bankrate

Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay.

. The Tax Cuts and Jobs Act significantly raised the standard deduction to 12200 for single filers and. Please contact the moderators of. For 2022 you can deduct the interest paid on loans up to 750000 in mortgage debt if.

Web Tax deductions can change from year to year. You may find our Taxes wiki helpful. 25900 Married filing separately.

The debt cant exceed 750000 or 1000000 if the loan was taken before. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. Ad Filing Taxes Is Fast And Easy With TurboTax Free Edition.

Web Mortgage interest paid on a home is also deductible up to certain limits. You may be able to deduct 100 of your mortgage interest paid in the previous year or. See If You Qualify Today.

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Web Mortgage interest deductions act as an incentive to taxpayers with homes since it allows them to deduct interests on loans related to purchasing building or. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

For married taxpayers filing a separate. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web How the Mortgage Interest Deduction May Not Help.

Ad Access Tax Forms. I am a bot and this action was performed automatically. Web How much you can deduct will depend on when you purchased your home.

Web The mortgage interest deduction allows you to deduct a limited amount of mortgage interest from your taxable income lowering the amount of tax you owe. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more. File With Confidence When You File With TurboTax.

The standard deductions for 2022 follow. Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. Web To claim the mortgage interest deduction a taxpayer should use Schedule A which is part of the standard IRS 1040 tax form.

For example a taxpayer with mortgage principal of 15 million on. Complete Edit or Print Tax Forms Instantly. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Ad Easy Software To Help You Find All the Tax Deductions You Deserve. 12950 Married filing jointly. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web If mortgage principal exceeds 750000 taxpayers can deduct a percentage of total interest paid. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Register and Subscribe Now to Work on Pub 936 More Fillable Forms.

Web Most homeowners can deduct all of their mortgage interest. Lets say you paid 10000 in mortgage interest and are. Your mortgage lender should send.

However higher limitations 1 million 500000 if married. Web Is mortgage interest tax deductible.

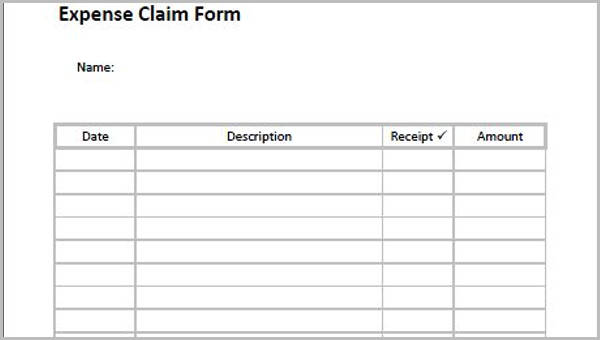

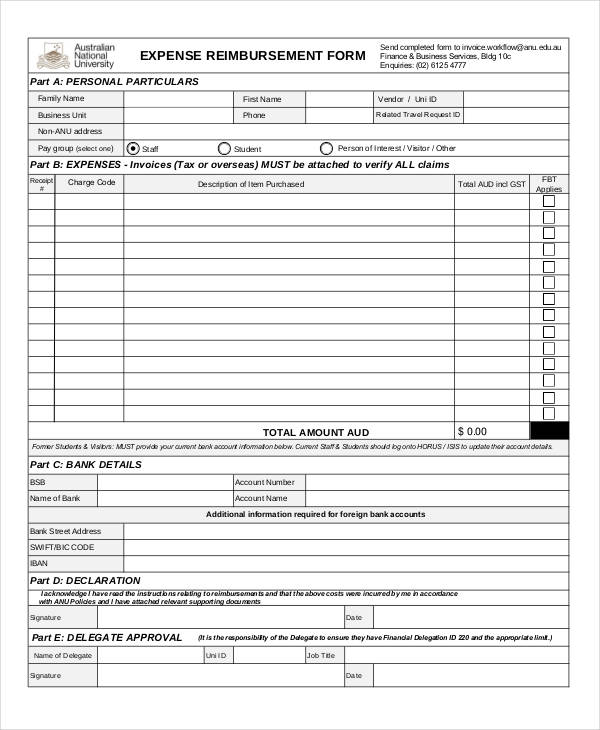

Free 32 Claim Form Templates In Pdf Excel Ms Word

Deducting Home Mortgage Interest In Unusual Circumstances Gilbert J Munoz C P A

Free 32 Claim Form Templates In Pdf Excel Ms Word

Sec Filing Agilethought

Mortgage Interest Tax Deduction What You Need To Know

How To Calculate A Mortgage Amortization Table Amortization Formula And Spreadsheet For Schedule A Tax Deduction

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional

Calculating The Home Mortgage Interest Deduction Hmid

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

The Mortgage Interest Deduction In 2019 2020 Youtube

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Crain S Detroit Business Sept 5 2016 Issue By Crain S Detroit Business Issuu

Mortgage Interest Deduction A Guide Rocket Mortgage

Mortgage Interest Deduction How It Calculate Tax Savings